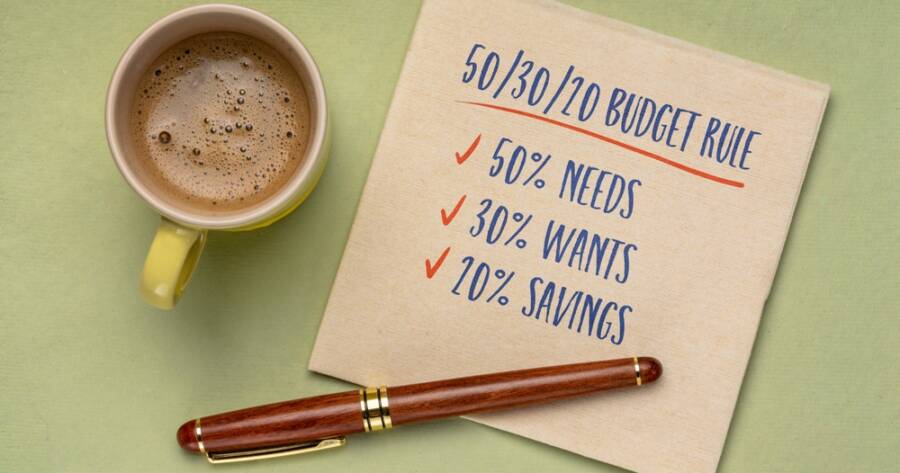

Finding balance between spending and saving can feel complicated, but the 50/30/20 rule simplifies the process. This approach divides after-tax income into three categories—needs, wants, and savings—making it easy to visualize where money goes. It encourages structure without rigidity, offering flexibility for any income level. When applied thoughtfully, the 50/30/20 rule turns budgeting from guesswork into clarity, helping build financial habits that are sustainable, practical, and perfectly suited for everyday life.

Understanding the Basics of the 50/30/20 Method

The 50/30/20 budgeting rule provides a simple formula: 50% of income goes to needs, 30% to wants, and 20% to savings or debt repayment. It was popularized by U.S. Senator Elizabeth Warren in her book All Your Worth, and has since become a go-to framework for managing money with balance. Its appeal lies in its simplicity—no spreadsheets or complicated calculations are required.

This method allows for both structure and flexibility. Instead of tracking every dollar in dozens of categories, you only need to focus on three. It creates awareness of spending habits while leaving room for personal preferences. Whether someone earns $3,000 or $10,000 a month, the formula adapts easily, making it a realistic foundation for long-term financial wellness.

Defining the “Needs” Category

Needs make up half of the 50/30/20 budget and include essentials required for living. That means rent or mortgage payments, utilities, insurance, groceries, and transportation. Health expenses and minimum debt payments also fall under this section. The idea is to keep basic living costs within 50% of take-home pay, ensuring necessities don’t overwhelm income.

For many households, that percentage can feel high—especially in cities with steep housing or food costs. If 50% isn’t achievable, it’s okay to adjust temporarily. The goal isn’t perfection but awareness. Understanding how much of your income goes to essentials helps identify where to cut back or what needs to change over time, like refinancing a loan or moving toward more affordable housing.

Understanding the “Wants” Category

Wants represent the enjoyable parts of spending—what makes life more comfortable and fun. Dining out, streaming subscriptions, vacations, and hobbies all fall into this 30% category. Even upgrading to premium services or shopping for non-essential items qualifies as a want. Recognizing this distinction helps prevent emotional spending from blending into perceived “needs.”

This portion of the budget provides flexibility without guilt. Allocating money for enjoyment ensures financial discipline doesn’t feel restrictive. People are more likely to stick to a plan when it supports their happiness rather than eliminates it. By tracking lifestyle spending and keeping it intentional, it’s possible to enjoy small luxuries without losing sight of long-term goals.

Allocating the “Savings” Portion

The final 20% of income is dedicated to savings, investments, or paying down high-interest debt. This portion builds financial security and future freedom. It includes contributions to emergency funds, retirement accounts, or investment portfolios. Debt reduction—especially credit cards or personal loans—also counts as part of this category since it directly strengthens financial health.

Automating savings can make this process effortless. Setting up automatic transfers after each paycheck ensures money is saved before it’s spent elsewhere. Even if the 20% target feels ambitious, starting smaller still makes progress possible. Over time, consistent savings habits grow into meaningful financial stability, making it easier to handle unexpected costs or pursue bigger goals.

Adjusting the Rule for Your Lifestyle

While the 50/30/20 rule offers a clear structure, real life often requires flexibility. People with higher living expenses or variable income may need to tweak the ratios to fit their circumstances. For example, 60/20/20 might work better for families with high rent costs, while 40/30/30 could benefit aggressive savers. The strength of the rule lies in its adaptability, not its rigidity.

The goal is to use it as a compass, not a cage. Regularly reviewing your budget ensures it aligns with your evolving priorities. As income grows or expenses shift, adjusting the categories keeps progress on track. A flexible mindset transforms budgeting into a lifelong habit rather than a temporary challenge.

Making Simplicity Work for You

Financial success often comes from consistency, not complexity. The 50/30/20 rule helps maintain that balance by blending discipline with freedom. It offers an easy structure that supports both security and enjoyment without the stress of constant number crunching.

When money is divided intentionally, spending choices become clearer and guilt-free. Over time, this simple framework can lead to greater confidence, peace of mind, and the steady growth of lasting financial wellness.