Practical Content

We break down financial topics into simple, actionable advice, helping you make smarter decisions about saving, spending, and planning for your future.

We break down financial topics into simple, actionable advice, helping you make smarter decisions about saving, spending, and planning for your future.

Every article is carefully researched and reviewed to ensure accuracy, clarity, and real-world relevance, so you can trust the guidance you’re reading.

Our team of experienced writers is dedicated to creating content that educates, empowers, and inspires confidence in every money move you make.

Opening a first bank account is a milestone in teaching kids financial independence. It marks the transition from saving in jars to managing money responsibly in the real world. Beyond convenience, it’s a valuable learning experience that introduces budgeting, goal-setting, and accountability. By guiding children through the process, parents can build their confidence and help […]

3 minute read

As teens approach adulthood, money lessons become more meaningful and more crucial. Understanding credit and debt early helps them avoid financial pitfalls and build a strong foundation for independence. From credit cards to student loans, the choices they make now can shape their financial future for years to come. By giving them practical tools and […]

3 minute read

An allowance can be a powerful teaching tool when introduced thoughtfully. It gives kids hands-on experience managing money, making choices, and learning accountability. The right age depends less on a number and more on maturity, when children begin to understand that money is earned and finite. Whether you start early with small amounts or later […]

3 minute read

Saving money doesn’t have to feel like a chore. For children, it can become a game, a challenge, or even a source of pride. When saving feels exciting, kids are more likely to build lifelong habits that encourage financial confidence. The key is to make the process engaging, hands-on, and rewarding. Turning money lessons into […]

3 minute read

Learning about money doesn’t have to feel like a lecture. It can be part of family fun! Board games that teach budgeting, spending, and saving create lasting lessons in an enjoyable, low-pressure way. They help kids understand the value of smart choices and the impact of planning ahead. Through play, families can build financial awareness […]

3 minute read

Some of the best money lessons don’t come from lectures; they happen naturally in daily life. From grocery shopping to planning a family outing, ordinary moments can teach powerful financial skills. When parents use those experiences intentionally, kids learn the value of saving, spending, and decision-making without feeling like it’s a lesson. Everyday activities provide […]

3 minute read

Money lessons that start early can last a lifetime. Children who learn how to manage, save, and respect money grow into adults who make confident financial decisions. Teaching the value of money isn’t about complex math; it’s about creating everyday experiences that show effort, reward, and responsibility. When money becomes part of natural conversation at […]

3 minute read

An allowance can be more than pocket money. It’s a chance to build lifelong money habits. The right system helps kids understand effort, patience, and accountability. When structured thoughtfully, it turns financial lessons into everyday practice. Allowances teach children that money doesn’t appear magically; it’s earned, managed, and used wisely. By connecting actions to rewards, […]

3 minute read

Retirement Ready

Retirement Ready

Retirement planning is full of misconceptions that can quietly stall progress. Some people think it’s only for the wealthy, while others assume there’s plenty of time to start later. The truth is, even small, consistent actions can lead to long-term security. Myths around timing, age, and investment risks often keep people from taking the right […]

3 minute read

Managing money doesn’t have to be complicated when the right tools are in your pocket. Budgeting apps have made it easier than ever to visualize spending, stay accountable, and align habits with financial goals. Whether someone prefers detailed tracking or effortless automation, there’s an app designed to fit every budgeting style. By connecting technology with […]

3 minute read

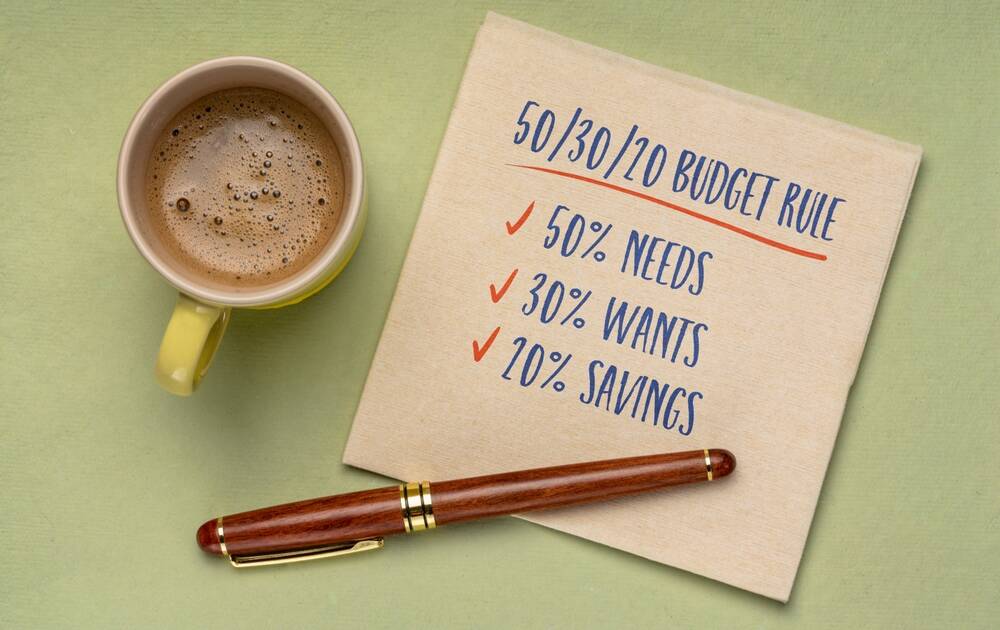

Finding balance between spending and saving can feel complicated, but the 50/30/20 rule simplifies the process. This approach divides after-tax income into three categories—needs, wants, and savings—making it easy to visualize where money goes. It encourages structure without rigidity, offering flexibility for any income level. When applied thoughtfully, the 50/30/20 rule turns budgeting from guesswork […]

3 minute read

Zero-based budgeting brings intention to every dollar earned. Instead of guessing where money goes, this method assigns every cent a specific purpose, from bills and savings to entertainment and debt repayment. The goal is simple: at the end of the month, income minus expenses should equal zero. It’s not about having nothing left but ensuring […]

3 minute read

Paying off debt can feel overwhelming, but choosing a strategy that fits your mindset makes all the difference. Two of the most effective methods—the debt avalanche and the debt snowball—approach repayment in different ways but share a single goal: building momentum toward financial freedom. Each has unique strengths depending on personality and motivation. Understanding both […]

3 minute read

Sometimes the best money habits come from simple, time-tested methods. The envelope system has been a budgeting classic for decades because it makes spending tangible and easy to visualize. Assigning cash to specific categories creates clear boundaries without complex tracking. Each envelope represents a purpose, keeping daily spending in check. It’s a hands-on approach that […]

3 minute read

Saving often feels like something to do after everything else is paid. The pay-yourself-first method flips that mindset by putting saving at the top of the financial to-do list. Instead of treating savings as leftover money, it becomes the first “bill” paid every month. This approach shifts focus from reacting to financial circumstances to actively […]

3 minute read

Retirement savings can feel like one of life’s biggest financial mysteries. The number that seems right for one person might feel impossible for another. The truth is, there’s no universal amount that guarantees comfort, only strategies that build security. The key is consistency, clarity, and adjusting as life changes. Whether the goal is early retirement […]

3 minute read

Choosing between a 401(k) and an IRA can shape how comfortable retirement feels decades from now. Both offer powerful tools for building wealth, yet they differ in flexibility, contribution limits, and employer involvement. Understanding those distinctions helps make confident, long-term decisions. The goal isn’t simply picking one over the other. It’s learning how each fits […]

3 minute read

A strong retirement budget balances comfort, security, and flexibility. After years of saving, the focus shifts from growing money to managing it wisely. Building a realistic plan ensures that income, expenses, and lifestyle stay in harmony for decades to come. The goal isn’t to restrict spending but to make it sustainable. With thoughtful organization, your […]

3 minute read

Retirement planning evolves with life. What feels distant in your 30s can suddenly become a top priority in your 50s. As responsibilities, income, and goals shift, so should your approach to saving and investing. Early decades are about building momentum, while later years focus on fine-tuning and protecting what’s been earned. Recognizing how strategies evolve […]

3 minute read

Social Security plays a crucial role in shaping retirement income, yet many people misunderstand how it actually works. Knowing when to claim, how benefits are calculated, and what factors influence monthly payments can make a major difference in long-term stability. Understanding the system allows you to make informed choices that maximize your income. With the […]

3 minute read

Reaching your 40s can make retirement feel both closer and more urgent. Life’s earlier expenses, like raising kids, buying a home, or paying off debt, often take priority, leaving savings lower than hoped. The good news is it’s not too late to build a strong foundation. With steady income, sharper focus, and better financial awareness, […]

3 minute read

Financial independence in retirement often means finding ways for money to keep working, even when you’re not. Passive income creates a steady cash flow that supports freedom and flexibility without full-time effort. From investments to creative ventures, there are many ways to build income streams that complement savings and Social Security. The goal isn’t constant […]

3 minute read

A successful budget isn’t about restriction. It’s about freedom! When a budget is realistic and personalized, it can empower financial confidence instead of frustration—the secret lies in designing a plan that reflects real habits, not idealized versions of them. By focusing on awareness, flexibility, and consistent check-ins, a monthly budget can become something that supports […]

3 minute read

Money decisions are rarely just about math. Emotions, habits, and environment all shape how people spend, often without them realizing it. Overspending can stem from stress, boredom, or the simple thrill of reward. Understanding the psychological triggers behind financial behavior enables greater control and awareness. Once spending is viewed through an emotional lens instead of […]

3 minute read

Asking for a raise can feel intimidating, but it’s one of the most powerful ways to grow income and demonstrate your professional value. Preparation and confidence are key to turning that conversation into a successful outcome. By combining data, timing, and clear communication, you can make a strong case that benefits both you and your […]

Career & Income Growth Sep 22, 2025

A great side hustle does more than bring in extra cash—it builds skills, confidence, and financial freedom. The right opportunity can fit seamlessly into your schedule while helping you reach long-term goals faster. Whether you want to save for a big purchase, pay down debt, or simply expand your income sources, smart side hustles create […]

Career & Income Growth Oct 1, 2025

Career growth isn’t just about talent or experience—it’s also about connection. Networking opens doors to opportunities that might never appear on job boards or in company newsletters. The relationships you build can lead to mentorships, collaborations, and new directions that shape your professional path. When approached with authenticity and curiosity, networking becomes more than self-promotion. […]

Career & Income Growth Sep 24, 2025

In a world where automation and technology continue to evolve, human connection has become the ultimate competitive advantage. Soft skills, like communication, adaptability, and emotional intelligence, shape how people work together, lead, and solve problems. They build trust, strengthen collaboration, and drive success in ways technical expertise alone can’t. No matter the industry or role, […]

Career & Income Growth Sep 25, 2025

Daily habits can quietly drain or build your savings without you realizing it. Small expenses (like lunches, coffee, and commuting) add up over time, often without adding much value. By making a few intentional changes during the workday, you can easily save hundreds each month without sacrificing comfort. The secret lies in planning, awareness, and […]

Career & Income Growth Sep 17, 2025

Sometimes, loyalty doesn’t pay the way it should. While staying with one employer can feel stable, changing jobs often provides the fastest path to significant salary growth. Each move brings new opportunities to negotiate higher pay, expand your skills, and align your work with your long-term goals. In today’s competitive market, strategic career moves aren’t […]

Career & Income Growth Sep 10, 2025

Employee perks often go unnoticed, yet they can make a major difference in your financial life. From health benefits to commuter discounts, many workplace programs quietly help employees save thousands each year. The secret lies in understanding what’s available and making the most of it. Turning company benefits into tangible savings doesn’t require extreme effort, […]

Career & Income Growth Sep 12, 2025

Asking for a promotion takes courage, strategy, and preparation. It’s more than requesting a title change—it’s about proving readiness for greater responsibility. By demonstrating consistent results and aligning your goals with the company’s vision, you can position yourself as the natural choice for advancement. The conversation is a milestone, not a gamble, and when approached […]

Career & Income Growth Sep 27, 2025